One of the trickiest parts of settling in the UK is securing somewhere to live. It’s expensive, it’s complicated – and did we mention expensive? So it’s no surprise that for most, renting is still the most affordable, flexible option when getting started.

87% of Marshmallow customers rent. So if you’re making a similar move, it’s important to understand all the ins and outs renting in the UK. Including the best places to start, all the costs involved and more.

To get all the answers you need, we spoke to James and Dani from Housing Hand. This is the UK’s No.1 rental guarantor service who, for a fee, legally agree to cover the cost of rent payments if a renter can’t pay.

As a result, they’re pretty knowledgeable when it comes to renting in the UK. Read on to see what they have to say.

Where’s the best place to start when renting a property in the UK?

For working professionals moving to the UK, James explains, property portals like Rightmove, Zoopla and OnTheMarket are the best place to start.

“Responding to adverts from individual landlords may be tempting,” says James. “But it can put you at increased risk of coming into contact with scammers.”

“Property portals, on the other hand, work hard to only feature regulated letting agents who have been properly vetted through redress schemes such as Propertymark. That means you can trust they’ll meet certain criteria.”

For students, they recommend international booking platforms such as , Uhomes,University Living, Amber Student and Uniacco to name but a few.

“Definitely look at a range of property portals to get a sense of all the properties available,” recommends James. “And our other top tip? Don’t hand over any cash to a letting agent (or landlord) until you’re sure the proper processes are being followed.”

What are the next steps?

Found a flat (apartment) or house you’d like to rent? Housing Hand explains what you need to do next.

Viewing

The first thing to do is book a viewing.

“Ideally, this will be in person. But some letting agents also offer online viewings, which can be useful for people who are planning ahead for their move to the UK from abroad,” explains Dani.

“You’ll be able to see each room virtually so you’ll have some idea of what you’re renting before you arrive. And remember, this should all be free. Letting agents aren’t allowed to charge you for viewings.”

Holding Deposit

Like what you see? To move forward with an offer, you may be asked to pay something called a holding deposit. This is to reserve the property while your references are checked.

Dani says the cost of this may vary. “I’ve seen some people pay £100, others £250. But it legally should not be more than the cost of one week’s rent.”

If you fail your right to rent check (more on that later), refuse to provide the agent with any information they need, or change your mind, you could lose the holding deposit. So only put down money if you’re serious about a property.

Otherwise, Dani reassures, this money will be deducted from your first month’s rent, or refunded if you’re refused for other reasons.

References

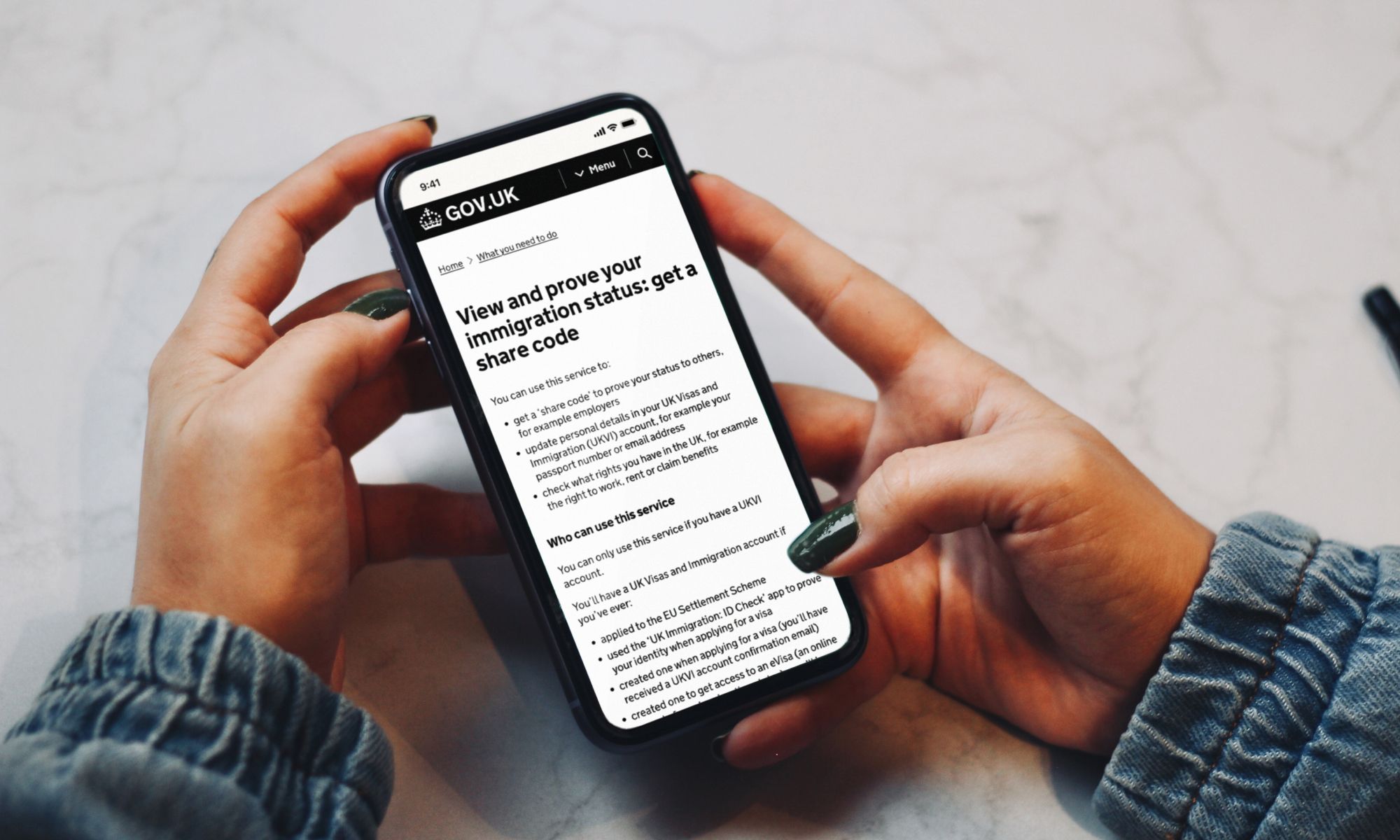

Anyone who has moved to the UK from abroad will first need to prove their right to rent, confirms James.

Nowadays, this can be done by providing your immigration share code. This is a unique code that you can generate via the UK government website that proves your immigration status.

You’ll also need to provide a few other documents. These include:

- A form of ID (like your passport)

- Proof of your income

- A credit check

“Your monthly income (before taxes and other deductions) will often need to be three times the rent payments to pass the affordability check, Dani says. “And they also like to see a good credit score.”

“So if your credit score is in need of a boost, or you don’t earn three times the rental amount, you may be asked to provide a rental guarantor. This is someone who legally promises to cover the cost of your rent if you can’t pay it.”

Many who are new to the UK find that they have a low credit score to start with – even if they had good credit back home. This is usually because your credit score is calculated based on your financial activity within the UK only.

Find out more about Housing Hand rental guarantors

What other costs are there?

Aside from a holding deposit, there are a few other up-front costs of securing a property to factor in, warns James. These include:

- Security deposit (up to the worth of 5 weeks’ rent)

- Advance rent (usually 1 month)

“In essence you need to be prepared to pay roughly 10 week’s rent before you even move into property,” confirms James.

You should also check your tenancy agreement closely for details of other charges, Dani says.

“Letting agents can charge you for late rent, lost keys, some damages and if you end the tenancy early. But the Tenancy Fee Act bans charging for things like viewings and admin fees”.

What are your final top renting tips?

“The biggest mistake anyone makes is not setting a budget” says James.

It’s important to do research on all your living costs for your chosen area before you make any commitments. Only once you have made an accurate assessment of how much you need to spend monthly, will you know how much rent you can afford.

Do your due diligence

It goes without saying, but you should closely read a tenancy agreement before signing. James and Dani recommend checking in particular:

- The length of the tenancy

- The break clauses (reasons your contract can be legitimately be ended early)

- Any joint or several clauses (whether you have joint responsibility with other housemates for the rent)

- Whether pets are allowed

- What fixtures and fittings are included

- Pre-existing damages on check-in

“A common mistake we see is people misunderstanding the term of their tenancy”, says James. “If you're signing a contract for 12 months, but you're only expecting to stay for six months then you will potentially have to make up the full rent for the year.”

Use a letting agent

This is part of being diligent, James says.

“Going through a letting agent or residential property development company (known as Build to Rent or Co-living) gives you more protection. They will also give you a copy of the government’s how to rent guide that lists all the things you need to be aware of. It’s helpful to read this closely too so you know the right follow-up questions to ask.”

Need a rental guarantor?

Marshmallow customers can save up to 25% on a Housing Hand rental guarantor. Want to find out more? Read about Marshmallow Perks here.