Quick answer: A rental guarantor is someone who legally agrees to cover your rent and other tenancy costs if you can't pay them yourself. Landlords commonly ask for guarantors when tenants have limited UK credit history or don't meet income requirements. It's particularly common for people who are new to the UK.

If you're renting in the UK for the first time, understanding guarantors is an important part of the process. But what exactly is a guarantor? And why are some people asked to provide one and others not?

If you've been asked to provide a guarantor, or someone has asked you to be one, this guide explains everything you need to know about how rental guarantors work in the UK.

What does being a guarantor for a rental property mean?

Being a guarantor for a rental property means you're taking on a legal responsibility to pay if the tenant can't. This isn't just about rent. As a guarantor, you could be liable for:

- Unpaid rent for the full duration of the tenancy agreement.

- Damage to the property beyond normal wear and tear.

- Cleaning costs if the property isn't left in good condition.

- Legal fees if the landlord needs to take action against the tenant.

Your commitment as a guarantor typically lasts for the entire length of the tenancy agreement. If the tenant has a 12-month contract, you're responsible for those 12 months. If the tenancy becomes a rolling contract after the fixed term ends, your guarantor responsibilities usually continue until the tenant or landlord ends the agreement.

The landlord or letting agent can contact you directly if rent payments are missed. They don't need to exhaust all options with the tenant first. This means you could be asked to pay even if the tenant is only a few days late with rent.

Being a guarantor can also affect your own finances. If you need to pay out on behalf of the tenant and they don't repay you, this could impact your ability to borrow money. Some mortgage lenders also ask if you're acting as a guarantor for anyone, as it represents a financial commitment.

Who can be a guarantor for rental property?

Not just anyone can be a rental guarantor. Landlords and letting agents set strict criteria to make sure guarantors can actually cover the costs if needed.

A guarantor usually needs to:

- Be over 18 years old.

- Live in the UK.

- Pass an affordability check.

- Be a homeowner or have significant savings.

People commonly ask their parents or close relatives to be their guarantor. Some ask trusted friends. But the person you ask needs to understand it's a serious financial commitment that could last a year or more.

For people who are new to the UK, finding someone who meets all these criteria can be particularly difficult. You might not have family in the UK yet. Or the family and friends you do have might not meet the income or homeowner requirements.

Who can be a rental guarantor if you're new to the UK?

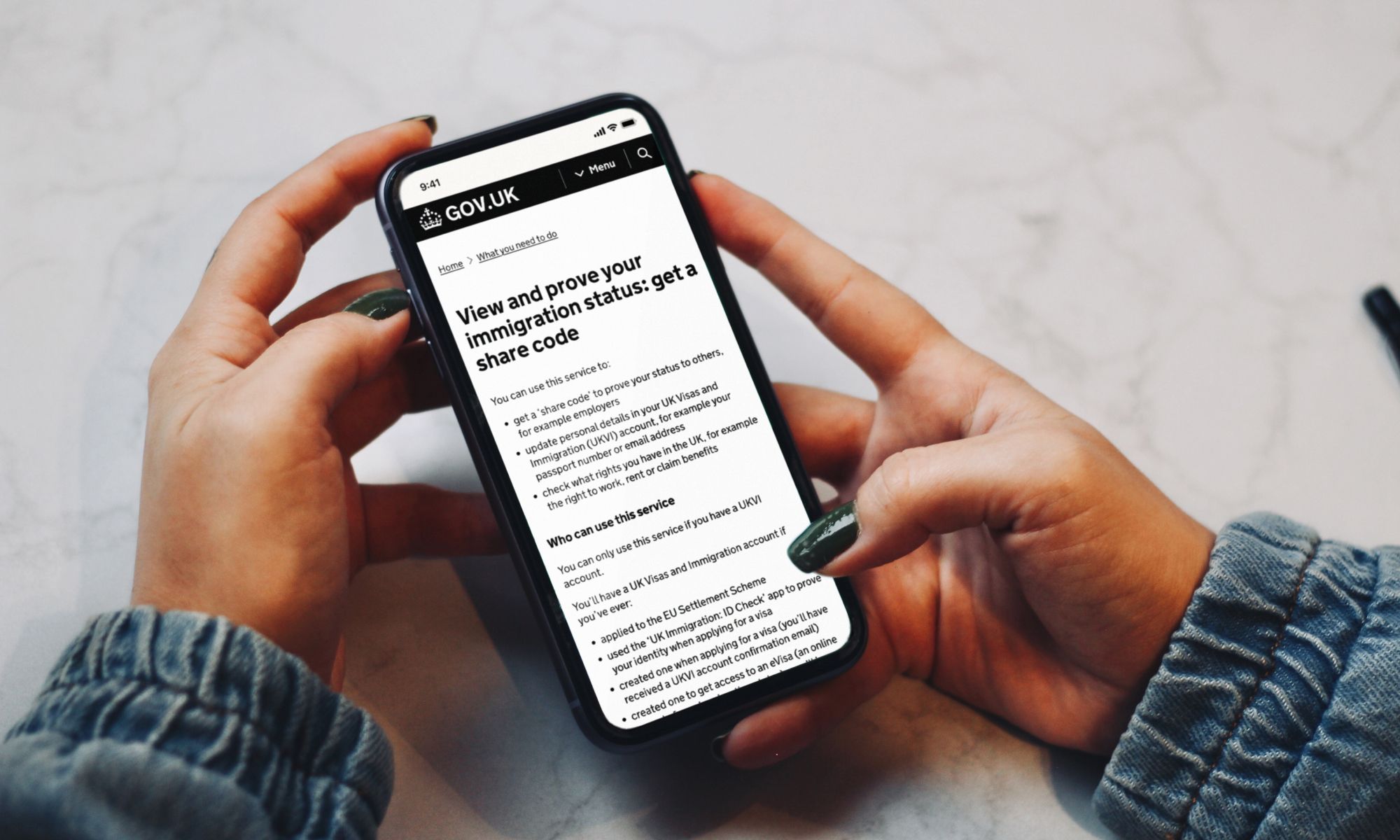

When you're new to the UK, you face a specific challenge with rental guarantors. UK credit scores only include information from UK companies, so even if you had excellent credit history in another country, your UK credit file will show very little.

Landlords often ask for guarantors when tenants:

- Have a low UK credit score.

- Don't earn three times the monthly rental amount.

- Are self-employed or have irregular income.

- Have recently moved to the UK.

If you have family members already living in the UK, they might be able to act as your guarantor if they meet the criteria. Don't assume they need to be homeowners. Some landlords and letting agents accept guarantors who rent, as long as they have a good credit score and meet the income requirements.

But if you don't know anyone in the UK who can be your guarantor, professional guarantor services offer an alternative.

How does a Housing Hand rental guarantor work?

We spoke to James and Dani at Housing Hand, a UK company that specialises in providing guarantor services for people who can't find a suitable guarantor themselves.

"If there's no one who can be your guarantor, Housing Hand can provide this service for a monthly or annual fee. We can accept an application around 99% of the time," explains James.

Housing Hand has more flexible requirements than most landlords:

- You only need to earn 1.5 times the rental amount, rather than three times.

- They don't require a credit check.

- You don't need to be a homeowner.

After your application is complete, Housing Hand confirms to your landlord or letting agent that they're acting as your rental guarantor. This gives landlords the security they need, while making it possible for you to rent without a personal guarantor.

The cost is structured over 12 months. "The monthly fee is usually roughly equivalent to one month's rent over that time," says Dani. "So if someone pays £1,200 a month for their rent, our fee will be around £100 per month. We also give a 10% discount for an up-front annual payment."

As an ethical company, Housing Hand will also advise you on other potential guarantors. "If we think you don't need us, we'll always tell you," confirms James. "Some people have family members in the UK who meet the criteria and don't realise they can ask them."

Marshmallow customers can save up to 25% on a Housing Hand rental guarantor. Want to find out more? Read about Marshmallow Perks here.

How do I stop being a guarantor for a rental property?

If you're currently acting as someone's guarantor and want to end this responsibility, you need to understand when and how you can do this.

Your responsibilities as a guarantor typically end when:

- The fixed-term tenancy agreement expires and isn't renewed.

- The tenant gives notice and moves out.

- The landlord agrees in writing to release you from the agreement.

- A replacement guarantor is found and approved.

- The property is sold and the new landlord doesn't require the same guarantor agreement.

For fixed-term tenancies, your commitment usually covers the agreed period. If the tenant signed a 12-month contract, you're generally responsible for those 12 months. When the fixed term ends, your obligation typically ends too, unless you agree to continue as guarantor for a new term.

Rolling tenancies are more complicated. If the tenancy becomes a rolling contract after the fixed term, your guarantor responsibilities often continue automatically. You'll need to take action to remove yourself.

Steps to stop being a guarantor

- Check your guarantor agreement carefully. Look for any clauses about how to end your commitment. Some agreements include specific notice periods or conditions.

- Speak to the landlord or letting agent. Explain that you want to be released from the guarantor agreement. Be clear and direct about your reasons. Put your request in writing and keep a copy.

- Request written confirmation. If the landlord agrees to release you, get this in writing. A verbal agreement isn't enough. You need documentation that proves you're no longer legally responsible.

- Help find a replacement guarantor. The landlord might agree to release you if the tenant can provide a suitable replacement guarantor. Offer to help facilitate this if possible.

- Wait for the tenancy to end. If the landlord won't release you early, your cleanest option might be waiting until the current tenancy agreement expires. Make it clear you won't continue as guarantor for any renewal.

- Consider legal advice. If you're having difficulties or the landlord is being unreasonable, speak to a solicitor who specialises in housing law. Citizens Advice can also provide free guidance.

What if the landlord won't release you?

Landlords aren't legally required to release you from a guarantor agreement before it expires. If you signed a 12-month agreement, the landlord can hold you to those 12 months.

However, if your circumstances have changed significantly, such as financial hardship or serious illness, explain this to the landlord. Some may be sympathetic and agree to release you, especially if the tenant has been reliable with payments.

If the tenant is planning to move out soon, you could encourage them to give notice. Once they vacate and the tenancy ends, your guarantor responsibilities end too.

Remember that simply asking to be removed doesn't end your legal obligation. You remain responsible until you have written confirmation that you've been released, or until the tenancy agreement expires.

Alternatives to rental guarantors

If you can't find a suitable guarantor, several alternatives might help you secure a rental property:

Paying rent in advance

Some landlords accept 6 to 12 months of rent paid upfront instead of requiring a guarantor. This gives them financial security without needing a third party. You'll need significant savings for this option.

Higher security deposit

Offering a larger deposit, such as two or three months' rent instead of one, can sometimes satisfy landlords. However, there are legal limits on how much deposit a landlord can request, so check current regulations.

Rent guarantee insurance

This insurance policy pays the landlord if you can't pay rent. You pay the premium yourself, which removes the need for a personal guarantor. Costs vary depending on your circumstances and the rental amount.

Professional guarantor services

Companies like Housing Hand act as your guarantor for a fee. This works well if you're new to the UK or don't have family who can help. These services have more flexible requirements than personal guarantors.

Finding landlords who don't require guarantors

Some landlords, particularly private landlords renting out single properties, are more flexible about guarantors. They might be willing to rent to you based on other factors like employment contracts, savings, or references from previous landlords abroad.

Build your UK credit score

If you have time before you need to rent, focus on building your UK credit score. Get a UK mobile phone contract, open a UK bank account, and consider a credit-building credit card. A better credit score might mean you won't need a guarantor. Read our guide on how to boost your credit score in the UK for detailed tips.

Frequently asked questions

Can a guarantor be from outside the UK?

Most UK landlords and letting agents require guarantors to be UK residents. This is because it's much harder to pursue legal action against someone living abroad if they need to pay. Some landlords might accept guarantors from certain countries, but this is rare. Professional guarantor services offer a more reliable alternative.

Can I have more than one guarantor?

Yes, you can have more than one guarantor. This can be helpful if one person can't meet all the requirements alone. For example, you might have two guarantors who each agree to cover half the rent. The landlord or letting agent needs to approve this arrangement.

Does being a guarantor affect my credit score?

Being a guarantor doesn't automatically affect your credit score. However, if the tenant misses payments and you don't cover them, this could appear on your credit file. If you need to borrow money while acting as a guarantor, lenders might see this commitment as a financial risk.

Can I be a guarantor if I rent my home?

Some landlords accept guarantors who rent rather than own their home. You'll still need to meet the income requirements and have a good credit score. However, many landlords prefer homeowner guarantors as they represent lower risk.

What documents do I need to be a guarantor?

You'll typically need to provide proof of identity like a passport or driving licence, proof of address such as recent utility bills, proof of income like payslips or tax returns, and bank statements showing at least three months of transactions. The landlord or letting agent will also run a credit check.

How much does a professional guarantor service cost?

Costs vary by provider and rental amount. Housing Hand charges roughly the equivalent of one month's rent spread over 12 months. For a £1,200 monthly rent, you'd pay around £100 per month. Many services offer discounts for annual upfront payments. Marshmallow customers can save up to 25% on Housing Hand services.